The Great Currency Conversion Scam

The Great Currency Conversion Scam

BEUC NEWS - 21.11.2017

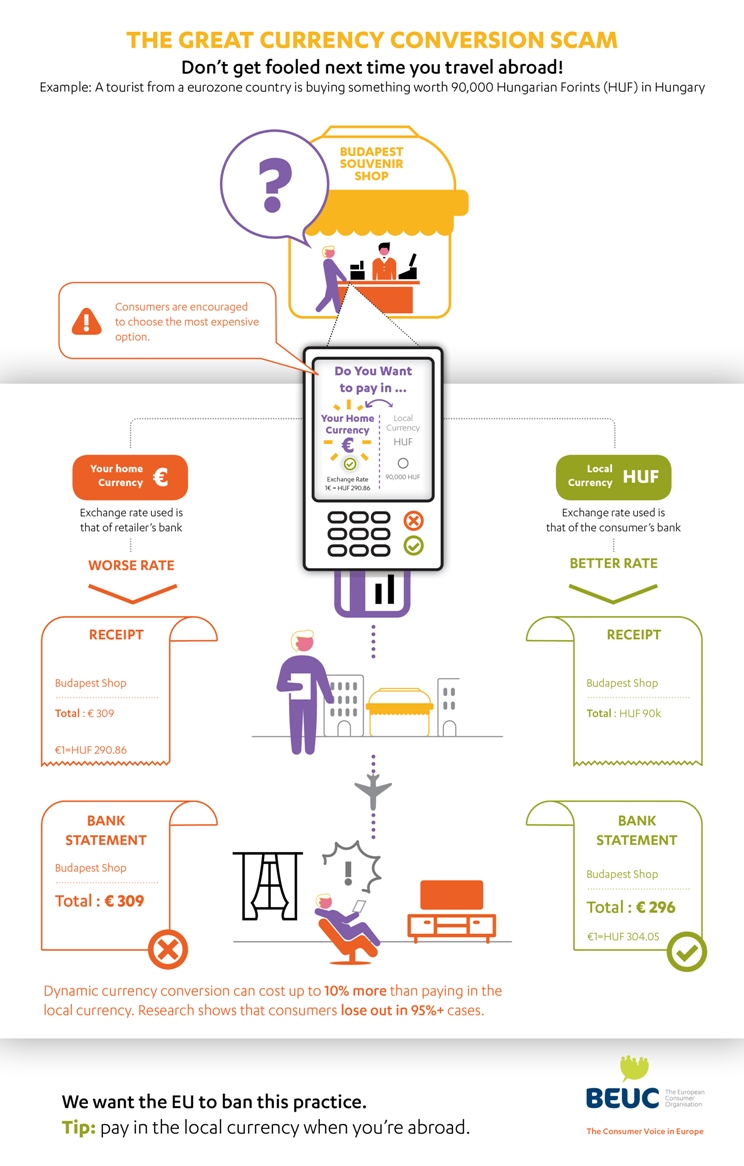

It has probably happened to you if you travel: cash dispensers and payment terminals abroad giving you the dilemma of whether to pay, or withdraw money, either in your home currency or in the local currency. Most people logically opt to pay in the currency they’re used to, but it’s actually a trap. In doing so, you end up paying more.

This practice of paying in one’s home currency, which is called dynamic currency conversion, happens abroad at ATMs, in airports, in shops, but also online. When faced with this choice, the exchange rate used to pay in your home currency is almost always worse than ‘standard’ exchange rates. And the consumer has no way of realistically comparing the two options (paying in the local currency or in his home currency). He has incomplete information about the different exchange rates and charges of either option and is used forced to make complicated calculations in the space of seconds when in a queue.

It’s an expensive scam: in the UK alone, it’s estimated to cost consumers around £500 million a year.[1] Research into this practice across Europe shows consumers are almost always losing out when they pick the home currency option.[2]

Today we’re releasing material about this practice (infographic | position | factsheet) and are calling on the European Commission to issue a full ban when it looks into the issue next year.

[1] Financial Times, Don’t get burnt by foreign credit card charges, 19 Oct 2017, https://www.ft.com/content/fd20820a-b412-11e7-a398-73d59db9e399.

[2] Stiftung Warentest, Geldabheben im Ausland: Vorsicht bei Sofortumrechnung in Euro! (2016) https://www.test.de/Geldabheben-im-Ausland-Vorsicht-bei-Sofortumrechnung-in-Euro-5014581-5015436/.